Procedural Updates

Congressional Committee Holds Hearing on NFIP

The federal Financial Services Committee met Wednesday, June 7, 2017, to discuss the National Flood Insurance Program (NFIP) in a hearing titled, “Flood Insurance Reform: A Taxpayer’s Perspective.”

The program is set to expire on September 30, 2017, and the legislature currently has six house resolutions on the table to reform the NFIP. If passed, these measures would improve flood premium affordability, open the market to private insurers, address insurance fraud, and allow local mapping of flood-prone areas as an alternative to NFIP maps.

Congressman Jeb Hensarling, Committee Chairman, stated that the NFIP runs an annual actuarial deficit of $1.4 billion, and faces a total debt of $24.6 billion. In addition, 2 percent of all policies account for 25 percent of all claims under the program.

Ranking Member Maxine Waters noted that Congress cannot allow the program to lapse, but that it should take measures, such as addressing cost, allowing a long-term reauthorization, and putting policyholders first, to ensure the NFIP’s success.

Five individuals participated in a panel to address concerns and questions posed by the committee. Those testifying had differing opinions on how best to improve the NFIP, but most agreed that providing more affordable flood premium rates and expanding to the private insurance sector would benefit policyholders.

The NFIP must be reauthorized by Congress this session to remain operational, but no legislation has yet made it to the floor of the House of Representatives.

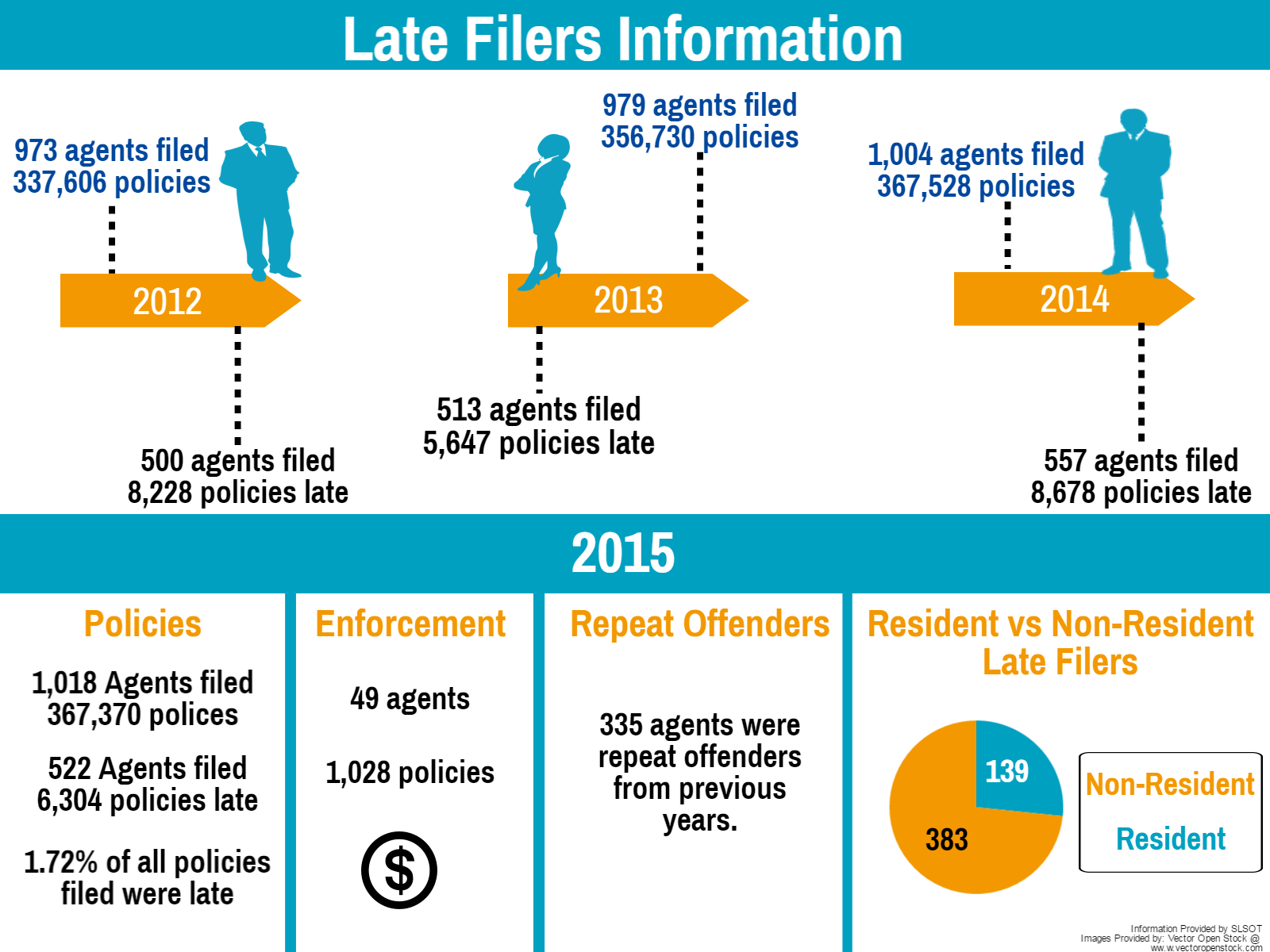

2016 Late Filers Information

Lone Star Lines – Volume 21, October – December

Commissioner of Insurance Approves Increase in Texas Stamping Fee Rate to 0.15% Effective January 1, 2016

On September 8, 2015, the Commissioner signed the order for the rate to be increased to .15% (.0015) from .06% (.0006), effective January 1, 2016.

The increased stamping fee rate will apply to each new or renewal surplus lines policy with an effective date on or after January 1, 2016. The new rate will also apply to policy date extensions if effective on or after this date. Policies effective on or before December 31, 2015 will run to expiration, cancellation, or next annual anniversary date (for multi-year policies) at the old rate of .06%. This includes any subsequent endorsements, audits, cancellations, reinstatements, installments, and monthly or quarterly reports.

In June 2015 the Board of Directors of the Surplus Lines Stamping Office of Texas approved a resolution recommending to the Commissioner of Insurance an increase in the stamping fee rate charged on gross premium of Texas surplus lines policies. Notice of this request was published in the Texas Register on July 31, 2015.

Lone Star Lines – Volume 21, July – September

Lone Star Lines – Volume 21, April – June

Lone Star Lines – Volume 21, January – March

2014 Policy Count Data Call

On February 12, 2015 eligible surplus lines insurers were directed by Commissioner’s Bulletin #B-0003-15 to report to the Texas Department of Insurance (TDI) the number of policies in force in Texas as of December 31, 2014. The deadline for providing this information is March 1, 2015.

In years past, the Surplus Lines Stamping Office of Texas has responded to this request on behalf of surplus lines insurers. For several years now, more and more insurers have been reporting their own information to TDI. This year, we plan to prepare the policy count report for insurers, but insurers should then self-report that information to TDI. As always, we are available to answer questions regarding the policy counts reflected in our database. Our report will be run the last week in February 2015. Please refer questions to SLTX at (512) 531-1880.