Procedural Updates

Board of Directors Meeting Summary

The Stamping Office Board of Directors held a meeting on October 28, 2021. The meeting was conducted in person and via teleconference. The board discussed various topics on the agenda including approval of previous board minutes, 2022 Budget, Konica Minolta SOW, Global Search update, S&P Global Software Agreement, and the Headspring 2022 SOW.

This is a broad summary of the meeting and not intended to reflect official meeting minutes or detail the scope of any actions taken by the board. Once minutes are reviewed and approved by the Board, they will be added to the website under board minutes.

The dates for the next Audit & Finance Committee meeting and Board of Directors meeting are to be announced. As always, board meetings are available to the public, and information will be posted as they are announced.

SMART Release Updates October 2021

The October 2021 SMART release includes export capability which allows users to export any Advanced Policy search results in a CSV/Excel format. The full export contains all data points included and/or required with your filing submissions such as Coverage, Insurer, Policy Limit, or Reference/Custom ID. A basic export comprised of primary / basic data points is also included. Users will no longer have restrictions downloading monthly ASCII files for reconciliation, research, or analysis, and both export functions will allow users to view, download, and/or reconcile at any point during the month or year. The sections of the Agent User Guide which specifically pertain to October changes can be found here.

For your convenience, included are previous SMART releases API, Report, and Advanced Search. Testing is currently underway for External Filing to add the ability to manually input transactions within SMART. The first transactions (New and Renewal Policies) are expected in the November release.

Note: all current processes and procedures in EFS remain available and both systems will work concurrently until all features in SMART are fully delivered in 2022.

With each new release or significant deployment, additional notifications will be sent all Electronic Filing System (EFS) users. These notifications may also be found on our website under News>Procedural Updates.

SMART’s Agent User Guide is updated with each release and may be obtained directly from SLTX’s TechSupport team for any agency ready to utilize SMART’s features. Contact SLTX Tech Support by email or phone (512) 531-1880 or (800) 681-5848 with any questions.

Board of Directors Meeting Summary

On September 22, 2021, the Surplus Lines Stamping Office of Texas held their Audit & Finance Committee meeting pursuance to section 2(c)(10) of SLTX’s Plan of Operation. The committee discussed agenda topics including approval of the previous meeting minutes, discussion over the Year-to-Date Financial Updates, and discussion over the proposed 2022 budget.

The committee also discussed and passed motions regarding the approval of previous meeting minutes as well as the proposed 2022 budget.

On September 23, 2021, the Stamping Office Board of Directors held their fourth meeting of the year. The meeting was held in person and via teleconference. The board discussed various topics on the agenda including approval of previous board minutes, Insurance policies, Executive Director update, Operations Department update, IT Department update, Finance & Audit committee discussions regarding the YTD Financial update, and the 2022 Budget.

The Board of Directors also discussed and passed motions regarding the approval of previous meeting minutes, Insurance policies, Headspring SOW, and the 2022 budget.

This is a broad summary of the meeting and not intended to reflect official meeting minutes or detail the scope of any actions taken by the board. Once minutes are reviewed and approved by the Board, they will be added to the website under board minutes.

The dates for the next Audit & Finance Committee meeting and Board of Directors meeting are to be announced. As always, board meetings are available to the public, and information will be posted as they are announced.

Brown Appointed Texas Commissioner of Insurance

Governor Gre g Abbott announced Cassie Brown as the new Texas Commissioner of Insurance. Brown is the current Chief Executive of the Texas Department of Insurance (TDI). Prior to this role, she served as Commissioner of the Division of Workers’ Compensation (DWC) in 2018, 2019, and 2021.

g Abbott announced Cassie Brown as the new Texas Commissioner of Insurance. Brown is the current Chief Executive of the Texas Department of Insurance (TDI). Prior to this role, she served as Commissioner of the Division of Workers’ Compensation (DWC) in 2018, 2019, and 2021.

With more than 20 years of public service experience, Brown has overseen various regulations, markets, and activities related to the Surplus Lines industry.

She received a Bachelor of Arts in Political Science from St. Edward’s University and attended the Governor’s Executive Development Program at The University of Texas LBJ School of Public Affairs.

For more information on the new Commissioner, please utilize TDI’s website.

SLTX Records $767.1M in Texas Surplus Lines Premiums for August

SLTX recorded $767.1M in Texas surplus lines premium during the month of August, totaling $6.18B year-to-date. This results in a 6.9% (or $49M) increase and a 14.9% increase in YTD premiums compared to the same period in 2020, making it the highest recorded August for SLTX and the 7th largest premium in SLTX’s 33-year history.

Several lines of business demonstrated significant increases when compared to August 2020. The most notable growth was Property Multi-Peril / Package (residential, commercial, and historical codes) coverage, which rose $21.7M (or 113.9%). Additionally, Commercial General Liability and Allied Lines (residential, commercial, and historical codes) coverages recorded growth, up $20.9M (or 25.4%) and $11.2M (or 181.1%) respectively.

August 2021also showed a 3.5% decrease in the overall number of transactions filed (90,984) over the same period in 2020, resulting in a 0.7% decrease in transactions filed YTD. This same period also reflected a 7.7% decrease in policies filed (58,878), resulting in a 3.2% decrease YTD.

As with prior months, 56.8% of premium reported this month is attributed to renewal policies, which accounted for 37.1% of the items reported. Additionally, 38.7% of premium (and 27.6% of the items) reported is related to new business, and the remaining 4.5% of the premium (and 35.3% of the items) is a result of non-policy transactions such as endorsements, cancellations, audits, installments, etc.

Texas surplus lines premiums will continue to trend with the existing hard-market conditions into the fall, including results of the changes to the diligent effort requirements (TX87 SB1367). SLTX will continue monitoring the Texas surplus lines market and share additional data as it is recorded, or analysis is completed.

SLTX Board Welcomes Jeffrey Klein

Jeffrey M. Klein has been appointed to the SLTX Board of Directors as a non-public member with a term ending December 31, 2023, by the Texas Department of Insurance.

Jeffrey M. Klein has been appointed to the SLTX Board of Directors as a non-public member with a term ending December 31, 2023, by the Texas Department of Insurance.

Klein currently serves as Of Counsel to DC-based insurance regulatory firm, McIntyre & Lemon, PLLC. His practice includes counseling insurance carriers, brokers, agents, financial institutions, and advocacy before state banking and insurance regulators, including the National Conference of Insurance Legislators (NCOIL) and the National Association of Insurance Commissioners (NAIC). Klein holds over 40 years of experience representing insurance carriers, brokers, and financial institutions in regulatory and government relations matters. Prior to this position, he served with an insurance trade association, a carrier, a major broker, and its parent bank.

Prior to his role as a member of the SLTX Board of Directors, Mr. Klein served on the Council of Insurance Agents and Brokers (CIAB), Legal Counsels Working Group, the AIA Government Affairs Committee, NAIC SERFF Board (an industry-NAIC collaboration on rate/form filings reform and on the NAIC Industry Liaison Committee), numerous American Bankers Association committees, a number of state bankers associations, and was a member of the Financial Services Roundtable Insurance Working Group.

He received his J.D. from Brooklyn Law School and his B.A. in political science from New York University (Cum Laude). He is admitted to practice in New York and North Carolina and works primarily from Charlotte, North Carolina.

Board of Directors Meeting Summary

On June 23, 2021, the Surplus Lines Stamping Office of Texas held their Audit & Finance Committee meeting pursuance to code 2(c)(10) of SLTX’s Plan of Operation. The committee discussed agenda topics including approval of the previous meeting minutes and discussion over the Year-to-Date Financial Update.

The following day, the Stamping Office Board of Directors held their second meeting of the year. The meeting was held via teleconference and most members were in attendance. The board discussed various topics on the agenda including the welcome of their Newest Board Member, Jeff Klein, approval of previous board minutes, the F&A Committee report, Company business Updates, Executive Director Travel Approval, and discussion on the remaining 2021 Meeting Dates.

The Board of Directors also discussed and passed motions regarding the approval of previous meeting minutes as well as Executive Director travel approvals.

This is a broad summary of the meeting and not intended to reflect official meeting minutes or detail the scope of any actions taken by the board. Once minutes are reviewed and approved by the Board, they will be added to the website under board minutes.

The dates for the next Audit & Finance Committee meeting and Board of Directors meeting are to be announced. As always, board meetings are available to the public, and information will be posted as they are announced.

SMART Focus Group Update

SLTX recently conducted numerous focus group sessions that gave external user stakeholders the opportunity to provide feedback to the SMART system design and development teams. Interested external users were categorized into 4 types of user groups to provide insight on the broker landing page, conducting basic entries, and most importantly a refreshed “correction process”. Over a 4-day period, 81% of interested external users participated in one of twelve sessions hosted by SLTX.

The sessions proved to be productive with users providing feedback on user experience, processes, and updated workflows. The design and development teams noted several minor improvements which will enrich the overall manual entry process (e.g., warning the user if a submission appears to be a late filing) to ensure users will review and double-check entries.

Overall, stakeholders greatly appreciated the process improvements SLTX presented including enhanced search, export capabilities, and an updated correction process. User feedback from these groups include, “Solved about 95% of the angst from filings”, and “Will greatly reduce need for training since issues are addressed with expanded guidance and context”. The design team can break-down feedback requests and prioritize them before handing off to the development team to prepare specific requirements for each improvement. Each advancement may be incorporated into the existing External Filing development tasks or held as enhancements appropriate to the core functionality delivery.

Note that all current EFS processes and procedures will continue to be available and both systems will remain functional and work concurrently until the entire suite of features in SMART are fully delivered throughout 2022. With each new release or significant deployment, additional notifications will be sent to existing users of SLTX’s Electronic Filing System (EFS). These notifications may also be found directly on our website under News>Procedural Updates.

Please contact the SLTX Tech Support team by email or phone at (512) 531-1880 or (800) 681-5848 with any questions.

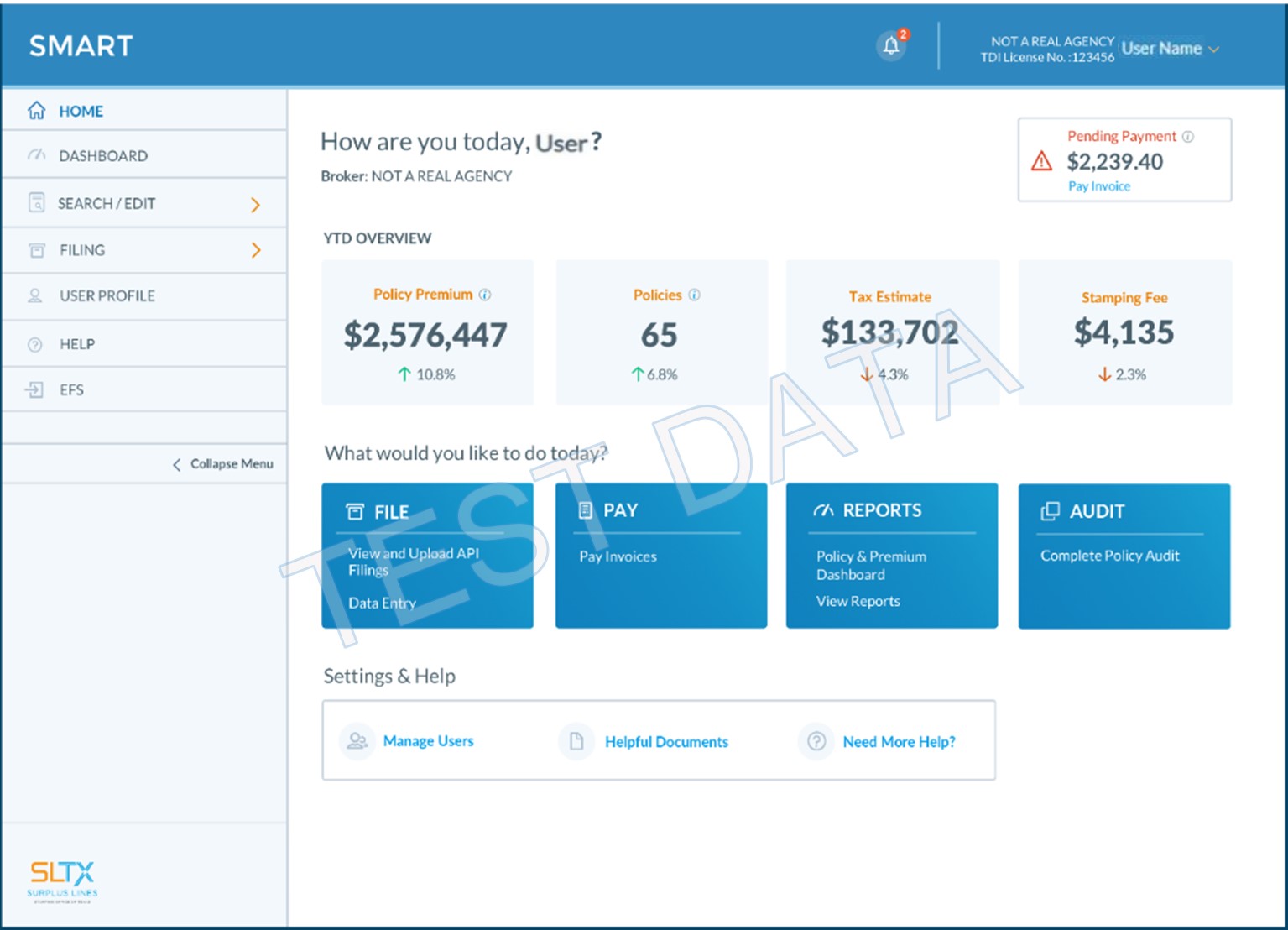

The screen shown represents the Broker Landing Page which users will see once logged into SMART. Here users are able to access features utilizing the left side navigation panel. Click here to view additional focus group progress and content.