US Stamping Offices Record 19.32% Premium Increase for 2019

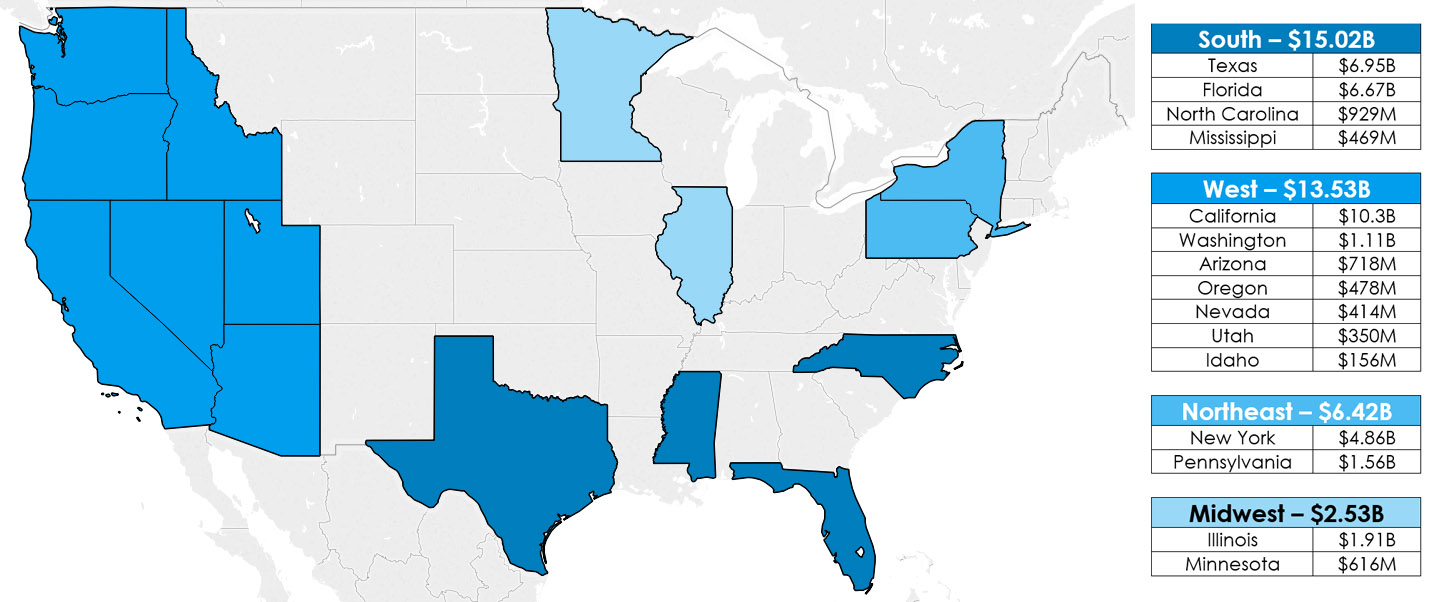

Excess and surplus lines (E&S) premium recorded by the 15 US surplus lines stamping and service offices reached $37.45 billion in 2019, a 19.32% increase over the $31.39 billion reported for 2018. Additionally, the 15 offices recorded a total of 4.83 million filings for the year, up 8.98% from 4.43 million in 2018.

All 15 states experienced growth in premium, with 12 of the 15 reporting double-digit premium increases. All states also had increased filing totals, and two experienced double-digit growth in this area. This year, California, Oregon, and Utah submitted 2018 premium and filing amounts that have been updated since the previous service office assessment.

California reported the largest premium amount in 2019 at $10.26 billion, though Michael Caturegli, Senior Vice President of Data Analysis and Technology for the Surplus Line Association of California, noted that this total includes $1.17 billion in premium that was processed in 2019 but dated for 2018. The Surplus Lines Stamping Office of Texas recorded the next highest premium amount at $6.95 billion, followed by the Florida Surplus Lines Service Office with $6.67 billion.

The highest percent of premium growth was also recorded in California. The state’s premium grew 34.13% over 2018. Idaho experienced the second highest percent increase at 33.57%. Wendy Tippetts, Manager of the Surplus Line Association of Idaho, Inc. noted that fire and allied lines premium doubled to $42 million and environmental impairment liability coverage increased to $5.8 million, which may have contributed to the state’s overall growth. She also saw small increases in professional liability for engineers and hospitals.

Other states with large premium growth were Arizona, Pennsylvania, Illinois, and North Carolina, with increases of 22.35%, 21.26%, 20.69%, and 20.59%, respectively.

“We saw broad based advances in the Illinois surplus line market in 2019,” said David Ocasek, Chief Executive Officer of the Surplus Line Association of Illinois. “GL, E&O/D&O, all risk property, and umbrella were the leading categories. Property/fire, multi-peril, inland marine, fidelity/surety, and auto physical damage were also very strong. In almost all of these major categories we experienced double digit growth – not just in premium and document volume, but also in the average premium per policy, which is a strong indicator of higher rates.”

In North Carolina, 80% of the surplus lines premium growth in the state was derived from commercial property and general liability classes of business, according to Geoff Allen, Chief Operating Officer of the North Carolina Surplus Lines Association.

“The general liability increase can be attributed to the state’s economy, and the property increase was the result of rate increases due to the two recent hurricanes,” Allen said. “We also realized significant increases in medical malpractice, cyber and credit insurance.”

The state of Florida recorded the largest number of filings for the year, at 1.29 million. Texas had the second largest total with 1.09 million. California experienced a 22.62% increase in items filed, the largest increase among the states, bringing its 2019 total to 895,534, though this includes 176,944 items that were part of a backlog. Utah had the second highest increase in filings, with a 12.15% growth for the year.

Effective January 1, 2019, the Surplus Line Association of Illinois reduced its stamping fee rate to 0.075%, an additional decrease from its reduction to 0.125% at the beginning of 2018. The Surplus Line Association of Oregon also decreased its stamping fee to $10 per transaction from $15, beginning January 1, 2019. On June 1, 2019, the Surplus Line Association of Idaho implemented a policy where premium, tax, and stamping fees are rounded to the nearest dollar, though Wendy Tippetts, Manager of the association, stated that the policy likely balanced out and did not have much of an impact on premium totals.

Moving forward, California has increased its stamping fee from 0.20% to 0.25%, effective January 1, 2020, and Florida plans to reduce its rate from 0.10% to 0.06% beginning April 1, 2020.