Harvey Impacts on Texas SL Market

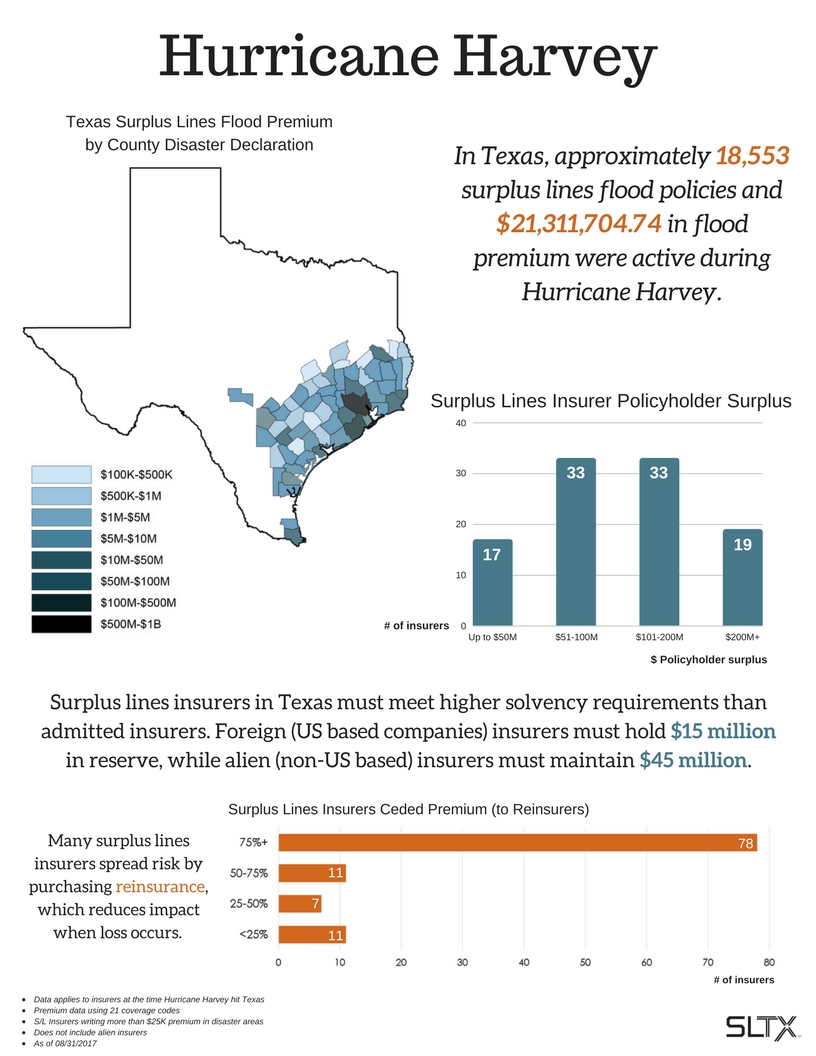

More than a month later, many Texans remain affected by Hurricane Harvey, which resulted in disaster declarations for dozens of counties. The Surplus Lines Stamping Office of Texas (SLTX) has taken a closer look at the surplus lines flood insurance policies in Texas that were active during the hurricane, and considered surplus lines insurers in disaster areas writing more than $25,000 in premium. While reports state that numbers as high as 83% of all residents in affected areas did not have flood insurance through the National Flood Insurance Program (NFIP) nor the surplus lines market, it is evident that the effects of this event will be felt for years to come.

Individuals and organizations from across the country have come together to provide aid and assistance in Texas. Houston and the surrounding areas are in the best place to rebuild cities now, but it is important to look ahead to prevent this type of loss in the future. The surplus lines insurance market is strong enough to take on an increased share of the flood market, and could act as an alternative or supplement to an existing National Flood Insurance Policy (NFIP) policy. Hurricane Harvey has caused little impact on the surplus lines market, demonstrating an increased capacity that could benefit many in Texas and beyond for years to come.