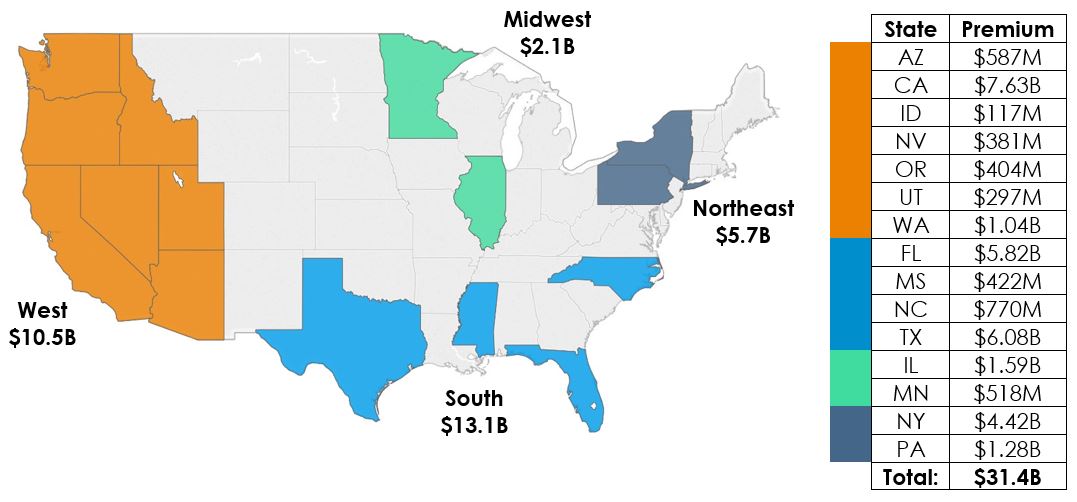

US 2018 E&S Premium Results

2018 has been the highest grossing year for the wholesale industry. Across the US, the excess & surplus lines (E&S) premium growth continues to outpace itself. Reported by Texas’ SLTX, the year ended on a high note with an 11.3% increase over 2017, with a total premium of $31.4 billion.

There are 15 US surplus lines service/stamping offices that administrate surplus lines insurance filings with various responsibilities, to include the advocacy, collection, development, and reporting of their state’s requirements. Together, they represent a huge market share of the US. Their strength in numbers supports an industry traditionally referred to as the “safety valve.” Wholesalers purposely attempt to design, innovative insurance products to fill the needs of consumers’ risks not written in the standard, admitted insurance market.

The fact that surplus lines premium growth is now more than $31 billion (from reported benchmarked service offices) speaks to the positive impacts the wholesale insurance community has had in quickly reacting for “hard-to-place, unusual and unique, or high capacity” coverage requests.

The surveyed states that experienced double-digit premium increases in 2018 were Nevada (23.9%), Washington (23.1%), California (16.5%), Texas (11.4%), Florida (10.9%), and New York (10.6%). Speaking from the state of Nevada, Lynn Twaddle, Executive Director, Nevada Surplus Lines Association, stated that the economy and growth in the state of Nevada has had a huge impact on the state’s surplus lines industry. Speaking on behalf of the state of Washington, Bob Hope, Executive Director, Surplus Line Association of Washington, stated, “Property lines were up almost $70 million, and a large part of that were DIC policies, plus stand-alone EQ and flood. Builders Risk also saw a $13 million increase.” Hope also added, “Casualty lines were up by almost $115 million, with the bulk of the increases in construction, E&O, and cyber.”

In terms of year over year filings, 2018 saw an increase of 7.5%, (from 4.1 million to 4.4 million transactions), with Utah and North Carolina recording the highest filing gains at 27.4% and 27.2%, respectively.

Sylvia Bruno, Executive Manager, Surplus Line Association of Utah, reported the large increase continues to be from the dissolution of the Non-Admitted Insurance Multi-State Association (NIMA). Bruno indicated, “Since Utah participated in NIMA, I feel that the greater part of our increase is now due to Utah being the home state where we now have exclusive authority over the taxation and are collecting 100%.”

For North Carolina, 2018 was the organization’s second year of operation and per Geoff Allen, Director of Operations, North Carolina Surplus Lines Association, many users and agencies were still becoming acclimated to its filing system.

Additionally, two states implemented stamping fee rate changes, effective in 2018, with Illinois reducing its stamping fee to 0.125% and Utah increasing its stamping fee to 0.18%.

Norma C Essary, CEO, SLTX added, “Nationwide, the positive trends point to a healthy industry that continues to support specialty insurance endeavors across the nation, and with the abundance of capital, interest rate changes, and a competitive marketplace, the familiar challenging environment will also continue. Despite challenges, opportunities present themselves, as evidenced in growth areas such as private flood, drones, the shared/service economy, robotics, and, without a doubt, cyber and terrorism.”

Historically, the market has grown by 48.2% over the past 10 years, with $21.2 billion in premium recorded in 2008, compared to 2018’s $31.4 billion.

The growth is encouraging for the future. Overall, the data suggests the favorable increases have had much to do with an economy that has allowed for slight premium increases. In prior years and across the US, property and casualty lines had been suppressed for so long that the recent renewal increases have justifiably invigorated the surplus lines market as a viable and stronger choice for consumer buyers.