2017 Record Breaking Year in Surplus Lines Market

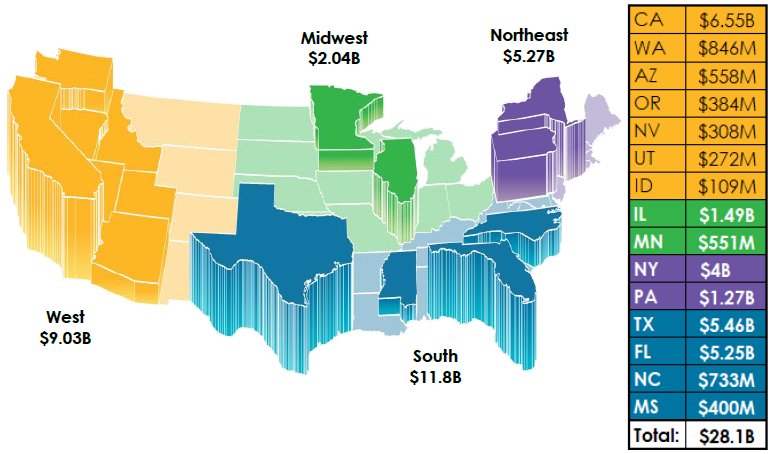

Across the United States, all fifteen (15) surplus lines service offices experienced increases in excess and surplus (E&S) lines insurance premium, totaling $28.1 billion. Information compiled by the Surplus Lines Stamping Office of Texas (SLTX) confirmed the national premium increase of 6.4% over 2016, which corresponds with the mid-year growth as reported in July 2017.

Of the $28.1 billion year-end 2017 total, the $1.69 billion increase was representative of two primary occurrences: the addition of a newly created North Carolina Service Office, and the demand for E&S policies, which saw increased (10%) policy filings over 2016.

Adding more positive results, every service/stamping office welcomed increases in E&S premium and policy filings, with the most notable being the state of Minnesota, which hailed 26.6% in premium growth. Other states having “double digit” increases included Utah (19.2%), North Carolina (17.1%), Oregon (16.8%), Arizona (16.4%), and Nevada (12.4%).

For the state of Nevada, the Nevada Surplus Lines Association’s Executive Director, Lynn Twaddle, stated, “The growth in staffing of mega factories has created a surge for housing, resulting in a residential construction boom. The legalization of recreational marijuana and its related operations have also attributed to the increase in surplus lines premium.”

While other states’ executive directors credit such increases to economic growth, Sylvia Bruno, Executive Manager of the Surplus Line Association of Utah, specifically noted that another contributing factor to the increase seen in Utah was the dissolution of the Non-Admitted Insurance Multi-State Association (NIMA), a multi-state tax sharing compact that ceased to exist.

The Southern Region of the US reported the largest total premium at $11.8 billion. The region includes newcomer North Carolina, whose $733 million premium contributed to the total Southern premium growth of 6.8%. In its 30-year history, Texas reported its best E&S premium year, ending at $5.46 billion.

Nevertheless, by having large population masses and robust business economies, California, Florida, and New York continued to be large-scale E&S states with 2017 being no different. Reported premium for California ($6.55B), Florida ($5.25B), and NY ($4B) enjoyed record-breaking numbers.

On a final note, it is evident that 2017 was a stable, growing marketplace for the wholesale insurance industry. This speaks to the wholesaler who has the expertise to innovate coverage(s) to meet consumer demands, new/emerging markets, catastrophic events, seamlessly along politically, changing landscapes. Even with the catastrophes sustained nationally and globally during 2017, the excess and surplus lines market is well aligned to handle the capacity and changes that our future continues to bring.